OCR Invoice Processing Revolutionizing Finance Industry

Are you still processing your invoices manually? Don’t you feel it becomes a bottleneck when the number of vendors increases? Go and ask your finance team; they will tell you how cumbersome it is to process the invoices manually. Those delays, processing costs, and accounting mistakes often lead to irregularities and stress. So, if everything is going digital, why not invoice processing? Yes, the OCR invoice is the solution to these never-ending challenges. The advent of OCR heralded a new era in which companies could expedite their invoicing operations, reduce errors, increase accuracy, and boost productivity. This article explores the sweeping impact of OCR invoices on the finance and accounting industries.

What is OCR Invoice Processing?

OCR Invoice Processing is a present-day technology that automates data extraction from invoices and other financial documents. It uses advanced algorithms and the latest techniques like Azure OCR Read to convert text from scanned paper invoices, PDFs, pictures, or other documents into machine-readable data. This extracted data holds information such as invoice numbers, dates, vendor information, line items, and amounts. Once extracted, the data can be analyzed, checked, and integrated into accounting systems or databases without the need for user intervention.

OCR Invoice Processing eliminates the need for manual data entry, which reduces errors, improves accuracy, and speeds up the invoicing process significantly. Businesses may optimize their accounts payable processes, assure timely payments, increase productivity, and focus on higher-level goals by automating repetitive tasks.

Who can derive the Benefits of OCR Invoice Processing?

OCR invoice processing is a flexible solution that offers great advantages to a wide range of users. Businesses of any size can improve their invoice processing methods by using this technology. Accounting and finance departments can automate data entry with OCR invoice, allowing professionals to focus on financial planning. The accounting team can benefit from streamlined processes, shorter approval times, and timely payments.

Not just them, but the procurement department can also take advantage of the leverage by easily matching the invoices with the purchase orders, ensuring precise payments and better supplier management. Additionally, the accuracy that OCR technology offers can help compliance and audit teams, streamlining audits and lowering compliance-related risk. In short, OCR invoice is useful for different verticals of the finance industry as it automates processes and boosts productivity.

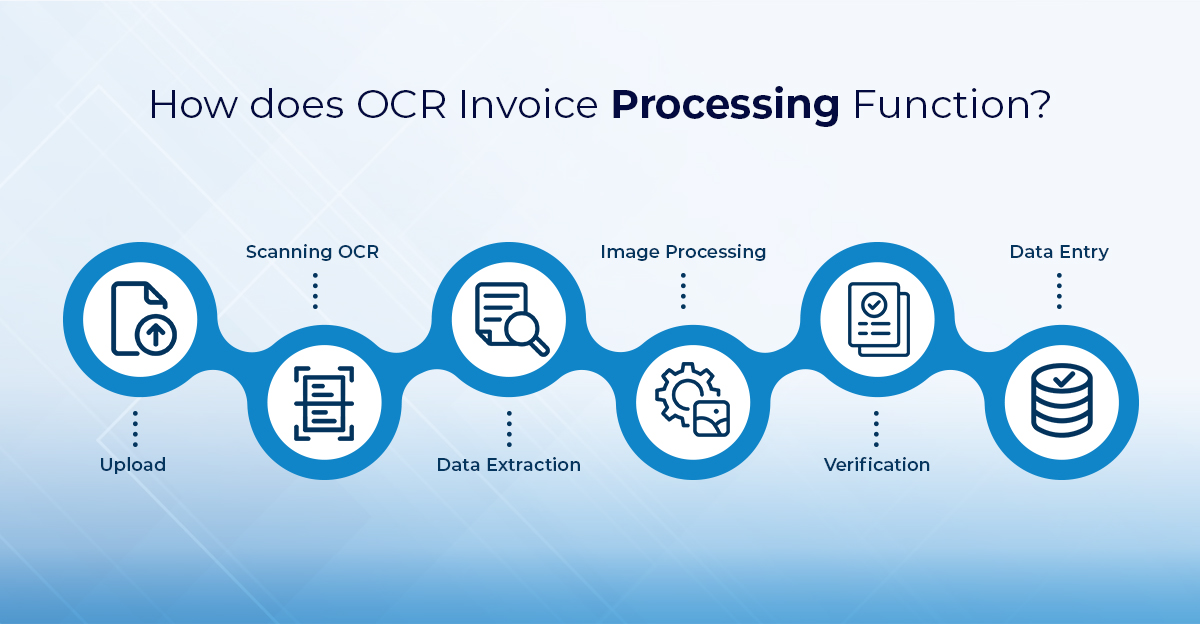

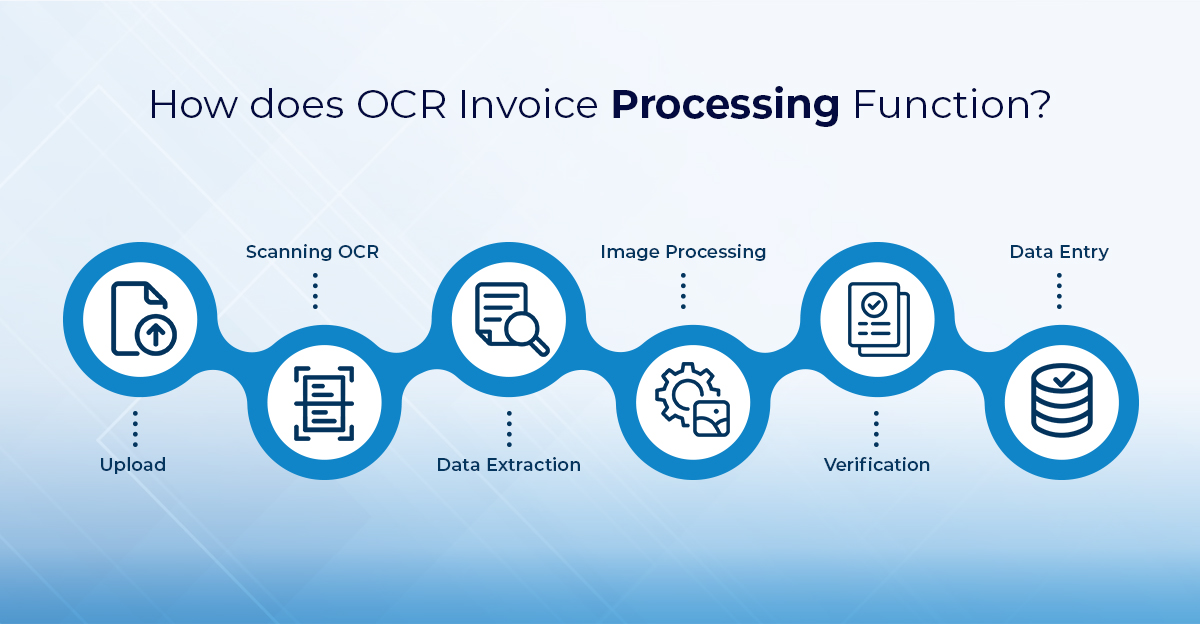

How does OCR Invoice Processing Function?

A vendor gave me a paper receipt yesterday, and today I received an email invoice. Is this similar to you too? Of course, yes, invoices can be received in any form—PDF, paper, word documents, or via email. Regardless of the invoice type, companies must manually input each line item into their ERP or accounting software. Employees may take an entire day to perform this seemingly simple task.

OCR invoice processing is a revolutionary solution that comes to save you here. This technology employs sophisticated invoice capture techniques like Azure Form Recognizer and Azure Cognitive Search to transform data into fully editable electronic invoices. And the best part about OCR invoice processing is that it doesn’t rely on a specific invoice format. Whether you are using a scanned document or a PDF, tables or forms, it makes use of advanced technologies like AWS Textract and Google Cloud Vision OCR effortlessly converts the text into machine-readable information and seamlessly integrates this data into your ERP system.

OCR invoice processing uses a combination of artificial intelligence and machine learning algorithms to convert your data into machine-readable texts that can be integrated into your ERP systems. For example, Beyond Key’s state-of-the-art OCR scanning services help you transform your paper trails into easily searchable and manageable digital documents. These documents are safe, backed up, and easily accessible. This efficiency eliminates tedious manual tasks and empowers your Accounts Payable team to use their energy for more productive work.

How Does OCR Invoice Processing Enhance Your AP Processes?

OCR invoice processing can remarkably improve your Accounts Payable processes by increasing effectiveness, precision, and affordability. Here are a few ways in which OCR invoices can transform your AP processes:

Data Entry Automation:

OCR technology enhances invoice processing by automating data extraction from the invoices. This saves time and effort and leaves no room for human errors, ensuring accurate input of invoices into the system.

Enhanced Accuracy and Data Validation:

OCR software is very precise when it comes to identifying and extracting text from invoices, which leads to improved accuracy and data validation. Extracted data can also be checked for accuracy and consistency using the tool’s built-in validation features.

Faster Invoice Processing:

As automation leads to quicker extraction and input of invoice data, OCR speeds up invoice processing. Quicker invoicing and approval times lead to faster payments, which ultimately improve vendor relationships.

Efficient Approval Workflows:

You can streamline the approval process by integrating OCR invoice with workflow automation. By automating the routing of bills for approval, we can speed up the invoicing process and eliminate bottlenecks.

Better Data Clarity and Analysis:

With OCR, data is not only extracted but also provides structure and easy access. It becomes much more manageable than traditional practices. The structured data can be used for in-depth analysis, giving businesses a better understanding of their purchasing habits, supplier evaluation, and future planning.

Cost Reduction:

OCR invoice processing eliminates the need for additional employees as it automates the majority of the manual tasks. This not only eliminates the risk of human errors but also saves a lot of money.

Improved Compliance and Security:

Automated invoice processing guarantees continuous adherence to compliance requirements and enhanced security. Integrating OCR technologies with safe cloud-based platforms improves data protection and accessibility while maintaining compliance with industry regulations.

Scalability and Adaptability:

OCR invoice processing systems are scalable and flexible enough to meet your company’s evolving needs. OCR systems can manage the workload efficiently, guaranteeing constant processing irrespective of the number of invoices received per day.

Conclusion:

Embracing OCR technology into invoice processing is more than simply a technological advancement; it is a strategic need for companies to succeed in the modern digital world. OCR allows businesses to focus on growth, innovation, and goals by freeing up employees from menial activities. The growing popularity of OCR invoice processing reflects an enterprise trend toward greater agility, competitiveness, and wealth. However, diving into OCR invoice processing requires specific knowledge gained over years of hands-on experience with these systems. Any robust invoice processing system demands consulting services to expertly guide you through the difficult process of deployment.

If your company is interested in automating its invoice processing, Beyond Key provides bespoke OCR solutions to meet your needs. You can choose our desktop OCR for simpler applications or look into our advanced data extraction solutions for more complex needs. We don’t just provide a service; we become a committed partner in your success. Contact us now!